In case you hadn’t noticed, your bank wants to upsell you more services – and sometimes that’s not a bad thing. Unless your bank happens to be HSBC.

There is a well known model in the financial industry for customer evolution that is based on lifetime customer value. If you deliver a great service and experience for your lower end customers, they come back and work with you once they become more “desirable” and higher paying customers. Almost every financial institution operates with this same basic assumption – and in most cases there’s absolutely nothing wrong with it. After the right financial organization earns your trust through great service, why shouldn’t they grow with you?

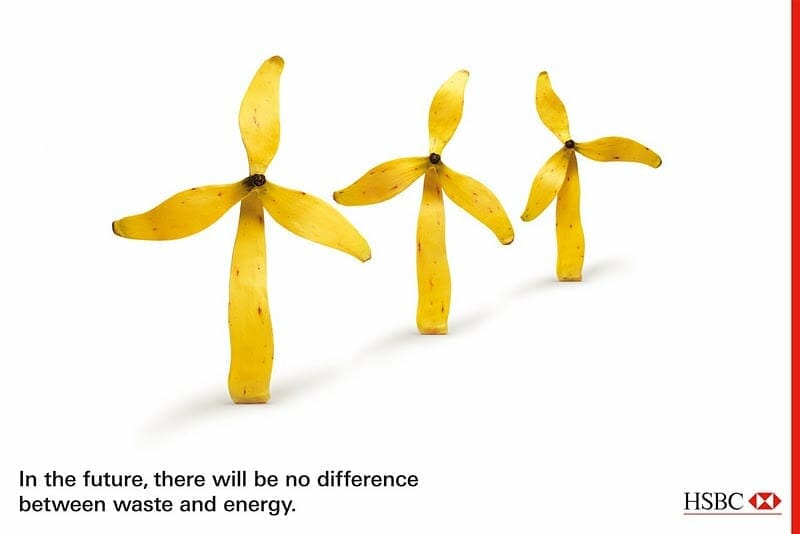

For years I have been an HSBC customer for my personal banking … and it was a good experience. Their advertising about being a global citizen and optimistic about the future was relevant for me and I would see it in every airport I landed in. I was in their “HSBC Premier” tier of personal service, which made me feel like a globe trotting super star. The services on my personal account was top notch and I was happy. Then I started my own business and it all went downhill.

This is the story of how HSBC lost me as a customer for life when it mattered most.

When I started my own business almost exactly a year ago, one of the first things I had to do was open a business banking account. Of course, HSBC was at the top of my list thanks to my great personal experience so I filled out an application online. That was November 30, 2012. Someone reached out right away, I filed my paperwork the next day – and all seemed good.

Unfortunately, it wasn’t.

Over the next 8 weeks, I went into the local branch six times to sign various paperwork or get materials verified by the local manager. Apparently they were “changing processes” so my old paperwork wasn’t usable anymore. Or they lost my Driver’s License copy. Or there was “just one more form.” So here’s what an average week looked like: I called their office four times to leave messages asking about the status of my application. Then I finally hear back about some new step involved that requires me to come back into the office.

In the meantime, I had already incorporated my business in my home state, filed my corporate paperwork, and was ready to start business. With no bank account.

After another two weeks of hearing nothing, I finally worked through their system to have the application expedited to a regional manager. That was January 30, 2013 – almost exactly ten weeks after starting the process to open a business account. Finally, the account was opened that day and my initial deposit check was posted. Unfortunately, they couldn’t share my account number with me for this new account unless I came into the branch (again) to get it in person.

So now we’re at 10 weeks after first applying for an account, more than a dozen calls, and about 7 visits to the local branch (in case you’re keeping track). Ah, but the fun doesn’t end there. In order to access my account online, I needed to have a special device sent to me that has a 6 digit code which changes every 30 seconds and apply for an entirely new account for online access. What’s the wait time for this device to arrive and set up this new account? Another 3-4 weeks.

Finally, after placing another 3 irate calls to supervisors – I get this email from the bank manager I was dealing with to open the account, sent on March 11, 2013:

“I’ve been told that your online banking access code will be set out tomorrow. You will receive it within 3 to 5 business days from tomorrow. Sorry for the delay.”

It took longer than that … but finally on March 23rd, 2013 – I first gained full online access to my business banking account with HSBC that I had first tried to open on November 30th, 2013. That’s exactly 144 days from application to access.

So you’re probably wondering why I would stick with a process this drawn out for so long? The smart thing would have been to find another bank long before. The biggest reason was probably professional curiosity. I just wanted to see how the process would end. Of course I suspected I might one day write about it. And that day happened to be today because of another HSBC horror story I just came across …

It was after reading this negative experience with HSBC from Huffington Post contributor Brett King that the timing felt perfect to share my own HSBC story as well. Firstly as a word of caution to any small business owner who may be considering doing their business banking with HSBC. But secondly, for the important marketing and business lesson this story offers.

Great advertising helped HSBC grow its reputation in my mind as a global resource and helped HSBC to be first on my list of banks to consider when the moment finally came for me to open my own business. In the marketing world, their advertising converted exactly how it was supposed to. But perfect advertising is not enough if the experience fails. And for HSBC, the experience failed so badly, it not only squandered every dollar they spent on advertising to reach a customer like me – it also inspired me to abandon that business account and move money out of my personal accounts with HSBC as well. And after reading Brett King’s experience with HSBC canceling his account without notice, I’m glad I did that.

Today I’m banking with a regional bank called Eagle Bank where I know the manager I work with by name. I’m happy with the service and imagine that when the time comes for me to require other banking services I will go to them first. All of which, I believe, proves that upselling your customers services they need can be a great thing for everyone … as long as what you’re selling isn’t a pitiful experience.

Photo Credit: Cat watching paint dry

Photo Credit: Keep calm and upsell

In Banking the marketing runs ahead of the capability. I’ve done process design for several major banks in the UK and without exception the IT and data management has been awful with lots of legacy and competing back office systems. No-one inside the bank knew what was really happening, never mind the customer.

One bank had a mortgage system which said they had to ring the customer every week, whether they had anything to tell them or not, but if your calling day was Monday and something happened on Tuesday you weren’t allowed to tell them until next week.

I believe it is because of the disconnect between earning and customer service – and the fact they are all as bad as eachother.

Banking is an industry absolutely ripe for disruption. I recently had a very similar experience to the one you describe, only with a school PTA account…an insignificant amount of money to the large bank involved, but for the numerous PTA board members who are also business owners, it was definitely noted that they treated us like we were insignificant. Those little interactions add up over time.